Very Sneaky

Published 21 years, 3 weeks past

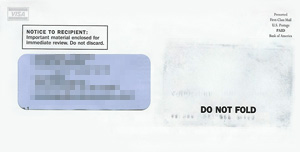

A recent post by Ferrett about sneaky marketing via faux-stained envelopes reminded me I had a similar trick envelope sitting around to be scanned and posted.

See that faint impression of a slightly askew credit card on the right half of the envelope? It looks just like the envelope got run through a rubber-wheel sorting mechanism, or maybe dropped and run over with a cart before being picked up, and the credit card being shadowed with dirt or something, right? There’s no card in the envelope. Inside this bit of chicanery is a “Pre-Approved Acceptance Certificate” that will let me transfer balances to a whole new card that they’d be just too darned happy to send me. Also a Fee and Rate Information pamphlet. That’s it—all paper. That faint card shadow is a bit of graphic design, nothing more.

See that faint impression of a slightly askew credit card on the right half of the envelope? It looks just like the envelope got run through a rubber-wheel sorting mechanism, or maybe dropped and run over with a cart before being picked up, and the credit card being shadowed with dirt or something, right? There’s no card in the envelope. Inside this bit of chicanery is a “Pre-Approved Acceptance Certificate” that will let me transfer balances to a whole new card that they’d be just too darned happy to send me. Also a Fee and Rate Information pamphlet. That’s it—all paper. That faint card shadow is a bit of graphic design, nothing more.

Oh, they’re good: too clever by half. Especially since, having seen this trick, I’m less inclined to do business with these jokers in the future. And I’d like to point out that the jokers in question are not Visa, except by indirection. The presence of their logo in the upper left corner implies that they sent it, but they didn’t. It’s just an offer for a Visa card through Bank of America.

I’ve actually gotten a few more nearly identical envelopes by now, so the trick doesn’t work quite as well; all I have to do is flex the envelope to tell if there’s a card in there or not, which I actually do with all envelopes I’m preparing to throw away. But what really twists my grin is the corporate branding in the masthead of the enclosed letter exhorting me to take advantage of the limited-time no-hassle offer that they did their level best to trick me into reading: “Bank of America — Higher Standards”.

Um… maybe not.

Comments (21)

This reminded me that I used to get credit card offers a while ago, although I’m not technically old enough to get one!

I agree any company who is comfortable enough to take me for an idiot will never see the colour of my money. Why can’t they use some of this creative energy to find a way of wasting time and paper?

This is indeed crafty but I still think one of the most effective schemes is the unmarked envelope. I am forced to open an envelope that has no return address on it and no other writing besides my address because it could be something important.

While that’s a brilliant little trick, it *does* strike me as more the prankster-boss type deal than anything else. And as for the youth and credit cards… I was sent one when I was 15, because my parents used my name to sign up for a magazine (still not sure why). Anyhow, they just sent me the offer without checking anything. <g>

Reminds me of a flyer I once received from the phone company (Bell Canada), which was printed on faux recycled paper. Now, why would anyone think THAT idea?!?

I got a credit card offer the other day that was cleverly disguised as a 1099-MISC form, with details of the offer inserted in a typewriter-ish font where the various fields of data were supposed to be. Most of it was covered except for the address window, so you had to open it… I nearly put it in my stack of tax stuff without opening, in fact.

I’m not sure whether to be disgusted or impressed.

My wife received one like Michael’s the other day, except that almost the entire front of the envelope was clear, was marked “W-2” in the top left, and all of the personal information (most of it fake) was clearly visible through the window. You could easily mistake it for a real W-2.

Personally, I think this type of practice is misleading and potentially harmful, given the right circumstances, and should be banned.

This technique would not work in the UK as evil postmen and postwomen would steal all the evelopes in the hope of getting a credit card to buy new trainers and things at Ikea.

I get these sorts of things all the time. My favourite is the one with ‘Priority Express’ across the top, in a fairly good simulation of DHL’s colours and layout. Except why would it arrive in my Postal box?

I still get a weekly offer for a Bank One credit card. Apparently they are not co-ordinated enough to realise I already have the exact card they are offering.

The sad thing is that I’m actually very happy with my Bank of America account. Their service is fairly decent, so tricking customers into signing up shouldn’t be necessary.

Personally, I’d rather get an envelope with a fake image like the above than one of those annoying fake credit cards that require more time to cut up since I can’t just run the whole thing through the shredder.

Here’s a tip if you don’t want to receive credit card offers at all: Call 1-888-5-OPT-OUT to notify the major credit bureaus to remove you from their mailing lists. (More detailed info is available in this kuro5hin article.)

I haven’t ever had this, but I have recieved a number of fake cards in the mail. Basically if there’s plastic in an envelope and I’m not expecting it, I cut through the card without opening it and drop the envelope in the burn basket. Living in the country, I have the luxury of burning whatever sensitive paperwork I’m through with.

As far as I’m concerned, credit cards are like e-mail attachments. If I’m not expecting it, it gets blackholed.

BTW, clever gateway question.

I think Citibank has been sending me “Last chance!” offers for one of their cards for about a year and a half now.

Then there’s the phrase “Please do not discard,” which seems to appear only on junk mail.

The number steve is talking about is 1-888-567-8688. It doesn’t notify the credit bureaus to remove you from their mailing lists as they don’t have any mailing lists. It notifies them to prevent unauthorized credit checks. By default, a bank can request your credit history without getting authorization from you and determine if they want to “pre-approve” you for a credit card.

It will take a couple of months for the offers to stop arriving in the mail but it is worth calling the number.

What a coincidence…

Just today I visited FTC Consumer Alert – Unsolicited Mail, Telemarketing and Email: Where to Go To “Just Say No”.

I opted out of DMA mailing lists (by printing forms I have to mail in) at http://www.the-dma.org/consumers/offmailinglist.html

I also called the number to opt-out (permanently!!) from pre-approved credit card offers. The robot that answered led me to optoutprescreen.com, “the official Consumer Credit Reporting Industry Opt-Out Prescreen website”, which was more convenient to use than the phone — but isn’t listed on the ftc.gov site.

Now, why do I have to do this??? There’s not enough time in the day to opt out of every thing in life there is to opt out of. This craziness has got to end. It exposes me to fraud, and it’s just plain messed up!

I’m not sure deception is the key here. If they were sending you your actual card it would be more disguised. Generally when I can see a card, I know it’s one of those fake cards with John Doe on it. Why they bother wasting money on those is beyond me, but I think this might have been the result of a graphic designer just trying to be clever. I could see myself doing this if I had to produce credit card applications day after day…anything to be a little creative in an otherwise very boring job.

I’m always getting those John Doe fake plastic “you’ve already been approved” ads with the “important, time sensitive information enclosed.” Apparently I’m credit gold.

However, at my place of employment I signed up for a store credit card so I could get a free pumpkin pie. As part of the application, I had to list my annual income. Which I did. A few weeks later I found out I had been declined because I don’t make enough. How could I, my only job is working at your store?

Oh well.. the pie was good at least.

Oh wow. I gotta admit thats pretty good!

I am getting mail from “domain registar of canada”. They make it look like my domain is in danger of expiration. The envelopes appear as they are from some Canadian Authority. And then inside they have an “easy form” for domain transfer. Only that they are 4 times more expensive than anywhere else.

Indeed a good reminder that the ancestor of unsolicited e-mail is unsolicited mail, and that sneaky techniques were not invented by spammers…

Well at least it had the terms and conditions in there. Capital One opened a card in my name without ever disclosing the membership fee ($60), the interest rate, or the due date!

When I called to get that info they said “don’t worry about it, it’s free for now.”

Fortunately I pressed the issue to find out that I was already down $120 without ever having agreed to open the account (application does not equal agreement, especially with no terms disclosed).

In order to shut me up they kindly cancelled all the fees, at which time I thanked them, closed the account, and informed them that I was going to make sure everyone who would listen knew that they were predatory lenders.

At least I gave them what they never gave me – a fair warning!

I used to work at a Lowe’s Home Improvement store, where I also was turned down by my own employer’s store card for making too little money. That was ten years ago, but things apparently haven’t changed.

You’d think the companies would eventually realize the effect that such policies have on employee retention?

Capital One keeps forgetting that I already have a CC account with them. These tactics of trying to make junk mail look important can have one side effect no one has mentioned:

When the “important” forms and letters actually arrive, the chances are much greater that they will be trashed, since the snail junkers have rendered terms like “Do Not Discard” utterly irrelevant. I have no time to open every single one. I destroy them on sight.

We only have to wait for a legal issue to come up where someone can claim ignorance based on not having been able to distinguish the important mailings from the junk. Unless it’s happened already…

I concur: Any business comfortable enough to take me for a fool will not see the color of my money, either.

Corporate America: Wise up. We’re not stupid and we will take you to task.